Real estate has long been a preferred investment avenue in India, offering opportunities for wealth creation, rental income, and portfolio diversification. In recent years, the real estate sector in Indian metro cities has undergone significant transformation, driven by urbanization, infrastructural development, changing buyer preferences, and government initiatives. Understanding current investment trends is crucial for investors seeking to navigate the dynamic property market in cities such as Mumbai, Bengaluru, Delhi, Chennai, and Hyderabad.

Growing Demand in Metro Cities

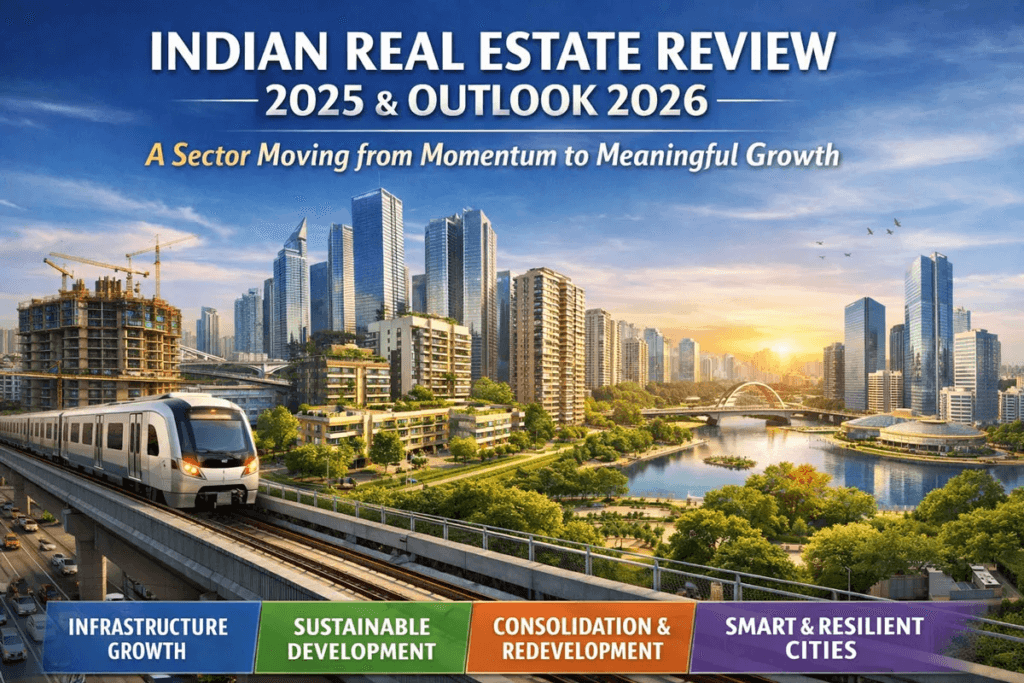

India’s metro cities continue to witness rapid urbanization, attracting migrants, professionals, and students. This population influx has fueled demand for residential and commercial properties, creating investment opportunities across different segments.

Residential real estate has seen a shift in demand patterns. Affordable and mid-segment housing remains highly sought after due to government schemes like the Pradhan Mantri Awas Yojana (PMAY) and favorable housing loans. Premium and luxury segments are also witnessing interest from high-net-worth individuals seeking urban lifestyles with modern amenities.

Commercial real estate is expanding alongside metro growth, driven by IT hubs, financial centers, and co-working spaces. Cities like Bengaluru and Hyderabad are attracting technology companies, while Mumbai remains a financial capital with robust office space demand. Retail and hospitality sectors are also evolving, offering diverse investment opportunities.

Government Initiatives and Policy Support

Several government policies have contributed to shaping real estate investment trends. The Real Estate (Regulation and Development) Act (RERA) has enhanced transparency and consumer confidence by ensuring accountability among developers. RERA-compliant projects reduce legal risks and protect investors’ interests, encouraging participation in the market.

Tax incentives and infrastructure initiatives have also influenced investment decisions. Affordable housing schemes, reduced GST on under-construction properties, and home loan interest deductions make residential investment attractive. Mega infrastructure projects like metro expansions, smart city initiatives, and expressway developments improve connectivity and property valuations in metro regions.

The government’s focus on sustainable urban development has also encouraged green and energy-efficient projects, which are increasingly appealing to environmentally conscious investors.

Shift Towards Digital and Technology Integration

Technology is redefining real estate in Indian metros. Virtual property tours, online booking platforms, and AI-powered analytics have transformed how investors identify, evaluate, and acquire properties. Digital tools provide real-time market data, price trends, and risk assessment, enabling informed decision-making.

Proptech startups have introduced innovations such as fractional ownership, co-living spaces, and smart home solutions, catering to changing lifestyles and urban needs. These developments are making real estate more accessible and flexible for investors and end-users alike.

Rental Yields and Investment Returns

Rental income continues to be a major factor driving real estate investment in metro cities. Cities like Bengaluru, Pune, and Hyderabad offer high rental yields due to demand from working professionals, IT employees, and students. Mumbai and Delhi, while having premium property prices, also provide lucrative returns in prime localities.

Investors are increasingly evaluating properties not just for capital appreciation but also for long-term rental potential. Mixed-use developments combining residential, commercial, and recreational spaces are becoming popular, offering diversified income streams and higher returns.

Emerging Trends in Buyer Preferences

Modern urban buyers and investors are prioritizing amenities, location, and sustainability over mere square footage. Demand for integrated townships, gated communities, proximity to workplaces, and access to public transport has grown significantly. Smart homes, energy-efficient buildings, and community-centric designs are influencing investment decisions.

The post-pandemic scenario has also shifted preferences, with a rising interest in larger homes, home offices, and green spaces. Co-living and shared accommodation options are gaining traction among young professionals and millennials seeking affordability and community living.

Challenges in Metro Real Estate

Despite strong demand, metro real estate faces challenges. High property prices, regulatory delays, and complex approval processes can pose obstacles to investors. Market volatility and economic fluctuations also affect buyer sentiment and property valuations.

Infrastructure bottlenecks, particularly in older urban areas, can impact project timelines and connectivity. Investors need to consider location-specific risks, developer credibility, and market trends before committing capital.

Fraudulent schemes, unregistered projects, and lack of transparency have historically been concerns in the real estate sector, making compliance with RERA and other regulations critical for safe investment.

Future Outlook

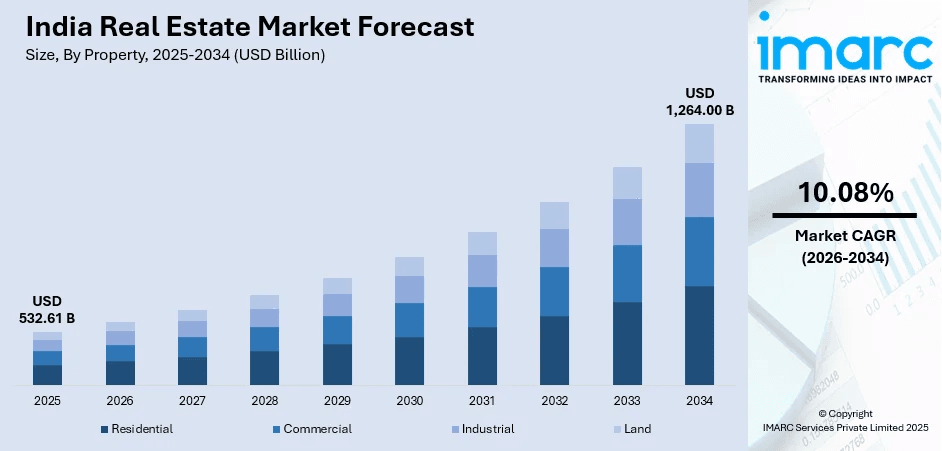

The outlook for real estate investment in Indian metro cities remains positive. Urbanization, rising income levels, and technology integration are expected to drive sustained demand for residential and commercial properties. Government initiatives promoting affordable housing and smart city development will further boost the sector.

Investors can expect continued growth in metro areas with strong infrastructure, employment opportunities, and lifestyle amenities. Emerging trends such as sustainable buildings, proptech solutions, and mixed-use developments are likely to shape the next phase of investment strategies.

Metro real estate is evolving into a more transparent, technologically advanced, and investor-friendly ecosystem. With careful planning, market research, and adherence to regulations, investors can capitalize on the opportunities presented by India’s dynamic urban property market.

Conclusion

Real estate investment in Indian metro cities offers significant potential for capital appreciation, rental income, and portfolio diversification. Growth is fueled by urbanization, policy support, technological innovation, and changing buyer preferences. While challenges such as high prices and regulatory complexities exist, informed investors who prioritize location, developer credibility, and market trends can benefit from the sector’s long-term growth. As metro cities continue to expand and modernize, real estate remains a key driver of wealth creation and economic development in India.

FAQs

1. Which metro cities offer the highest real estate investment returns in India?

Bengaluru, Hyderabad, Mumbai, Pune, and Delhi offer strong rental yields and capital appreciation potential.

2. How has RERA impacted real estate investment?

RERA has enhanced transparency, accountability, and consumer protection, boosting investor confidence in the sector.

3. What trends are influencing buyer preferences in metro cities?

Buyers now prioritize amenities, location, sustainability, integrated townships, and smart home solutions.

4. Is real estate a safe investment in Indian metros?

Yes, provided investors choose RERA-compliant projects, verify developer credibility, and analyze market trends carefully.

Next Topic: Government Schemes for Indian Farmers: Complete Guide

Also Check: How UPI Transformed Digital Payments in India