Artificial Intelligence (AI) is transforming the financial technology (fintech) landscape in India, particularly in the field of fraud detection. With the rapid growth of digital payments, online banking, and financial services, fintech firms are increasingly exposed to sophisticated fraud schemes. AI offers powerful tools to detect, prevent, and mitigate these risks, enhancing security, customer trust, and operational efficiency. By leveraging machine learning algorithms, big data analytics, and behavioral modeling, Indian fintech companies are able to identify fraudulent activities in real-time, reducing losses and improving compliance with regulatory requirements. This article explores the role of AI in fraud detection for Indian fintech firms, highlighting technologies, applications, challenges, and future trends.

The Growing Need for Fraud Detection in India

India’s fintech ecosystem has grown exponentially in recent years, driven by initiatives like Digital India, Unified Payments Interface (UPI), and widespread smartphone adoption. While digital transactions have increased financial inclusion and convenience, they have also opened doors for cybercriminals. Fraudulent activities in the fintech sector include identity theft, account takeover, phishing attacks, fake transactions, and money laundering.

Traditional fraud detection methods, which rely on rule-based systems or manual monitoring, are often inadequate to handle the scale and complexity of modern transactions. The speed and volume of digital payments in India make it impossible to detect fraud using conventional methods alone. For example, UPI transactions can reach hundreds of millions per day, and processing such high volumes manually is inefficient and error-prone.

AI-driven fraud detection addresses these challenges by using advanced algorithms that can learn from data patterns, detect anomalies, and adapt to new threats in real-time. This capability is particularly important for Indian fintech firms, where trust and security are critical for user adoption and regulatory compliance.

How AI Detects Fraud

AI employs several techniques to identify fraudulent activities in financial transactions. Some key methods include:

Machine Learning Algorithms

Machine learning (ML) enables fintech systems to learn from historical transaction data and detect patterns indicative of fraud. Supervised learning algorithms are trained on labeled datasets, where past fraudulent and legitimate transactions help the system differentiate between the two. Unsupervised learning identifies unusual patterns or anomalies without prior labeling, allowing the detection of new types of fraud.

Behavioral Analytics

AI systems analyze user behavior to detect deviations from normal patterns. For example, if a customer who usually transacts from a specific location or device suddenly initiates multiple high-value transactions from a different region, the system flags it as suspicious. Behavioral analytics can also monitor login patterns, device fingerprints, and transaction frequency to identify potential threats.

Natural Language Processing (NLP)

NLP helps fintech firms analyze unstructured data, such as emails, chat messages, and customer interactions, to detect phishing attempts, social engineering attacks, or fraudulent communications. By understanding language patterns, NLP algorithms can identify suspicious intent and alert security teams.

Real-Time Transaction Monitoring

AI systems can process millions of transactions in real-time, applying complex models to detect anomalies instantly. This enables fintech firms to block or flag potentially fraudulent transactions before they are completed, minimizing financial losses and enhancing user trust.

Applications of AI in Indian Fintech

AI-driven fraud detection has several applications across India’s fintech sector:

Digital Payments

With the rise of UPI, mobile wallets, and payment apps, digital payment fraud has become a significant concern. AI systems monitor transaction patterns, flag suspicious activities, and prevent unauthorized transfers. Companies like Paytm, PhonePe, and Razorpay use AI models to detect fraud in real-time, ensuring secure digital payment experiences for millions of users.

Lending Platforms

Online lending platforms are vulnerable to identity fraud, fake applications, and repayment defaults. AI algorithms verify borrower information, assess creditworthiness, and detect anomalies in application data. Machine learning models also help identify fraudulent patterns in loan repayments or collusive behaviors, reducing non-performing assets (NPAs).

Insurance and Wealth Management

Fintech firms in insurance and investment sectors use AI to detect fraudulent claims, unauthorized transactions, and money laundering attempts. Predictive models can flag high-risk claims or unusual investment behavior, improving risk management and reducing financial losses.

Regulatory Compliance

AI assists fintech firms in adhering to regulatory requirements, including Know Your Customer (KYC), Anti-Money Laundering (AML), and data privacy regulations. Automated fraud detection systems can identify suspicious transactions that require reporting to regulatory authorities, ensuring compliance while reducing manual effort.

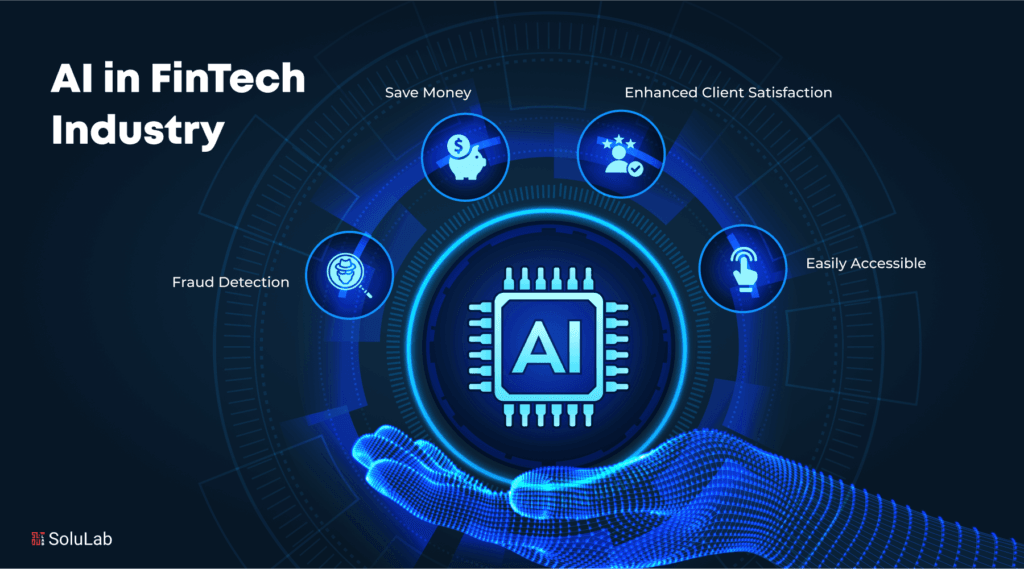

Benefits of AI-Driven Fraud Detection

AI adoption in Indian fintech provides several advantages:

- Enhanced Accuracy: AI systems can identify complex fraud patterns that may be missed by human analysts or rule-based systems.

- Real-Time Detection: Instant monitoring of transactions allows immediate action to prevent financial losses.

- Scalability: AI can process large volumes of data efficiently, supporting the rapid growth of fintech transactions.

- Adaptive Learning: Machine learning models evolve as new fraud techniques emerge, improving detection capabilities over time.

- Operational Efficiency: Automation reduces the need for manual monitoring, freeing resources for other strategic tasks.

Challenges and Considerations

Despite its advantages, implementing AI-driven fraud detection in India comes with challenges:

Data Privacy and Security

AI models require access to large volumes of personal and financial data, raising concerns about data privacy and protection. Fintech firms must comply with regulations such as the Personal Data Protection Bill and ensure secure handling of sensitive information.

Algorithm Bias

Machine learning models can inherit biases from historical data, leading to false positives or negatives. For example, certain user groups may be unfairly flagged as suspicious due to skewed training data. Continuous monitoring and model validation are essential to mitigate bias.

Integration with Legacy Systems

Some fintech firms rely on older infrastructure that may not be compatible with advanced AI models. Integrating AI solutions requires technical upgrades and careful planning to avoid operational disruptions.

Cost and Expertise

Developing and maintaining AI systems can be expensive and requires skilled data scientists, engineers, and cybersecurity professionals. Smaller fintech firms may face resource constraints in adopting advanced AI technologies.

Future Trends in AI Fraud Detection

The role of AI in fraud detection is expected to expand as fintech continues to evolve. Emerging trends include:

- Explainable AI (XAI): Providing transparent explanations for AI decisions to enhance trust among regulators, customers, and internal teams.

- Blockchain Integration: Combining AI with blockchain technology for secure and immutable transaction records, improving fraud traceability.

- Behavioral Biometrics: Using AI to analyze unique user behaviors, such as typing patterns and device interactions, to detect fraud more accurately.

- Collaborative Fraud Networks: AI systems across fintech firms sharing anonymized data to detect cross-platform fraud patterns.

Conclusion

Artificial Intelligence is revolutionizing fraud detection in India’s fintech sector by providing advanced, real-time, and scalable solutions to combat evolving threats. By leveraging machine learning, behavioral analytics, natural language processing, and predictive modeling, fintech firms can enhance security, maintain customer trust, and comply with regulatory requirements. While challenges such as data privacy, algorithm bias, and implementation costs exist, continuous innovation and adoption of AI technologies are critical for building a secure and resilient fintech ecosystem. As digital transactions grow in volume and complexity, AI-driven fraud detection will remain a cornerstone of India’s fintech industry, safeguarding both businesses and consumers while fostering confidence in the digital economy.

FAQs

- How does AI help detect fraud in fintech?

AI uses machine learning, behavioral analytics, NLP, and real-time monitoring to identify suspicious patterns and prevent fraudulent transactions. - What types of fraud are common in Indian fintech?

Common fraud types include identity theft, phishing, account takeover, fake loan applications, and money laundering. - Can AI completely prevent fraud?

While AI significantly reduces fraud risks, no system is 100% foolproof. Continuous monitoring and updates are essential to address new threats. - What challenges do fintech firms face when implementing AI?

Challenges include data privacy concerns, algorithm bias, integration with legacy systems, and high costs of development and maintenance.

Next Topic: Infrastructure Assets as Long-Term Investments in India

Also Check: India Must Accelerate AI and Industrial Automation to Unlock Manufacturing Potential: A Strategic Imperative