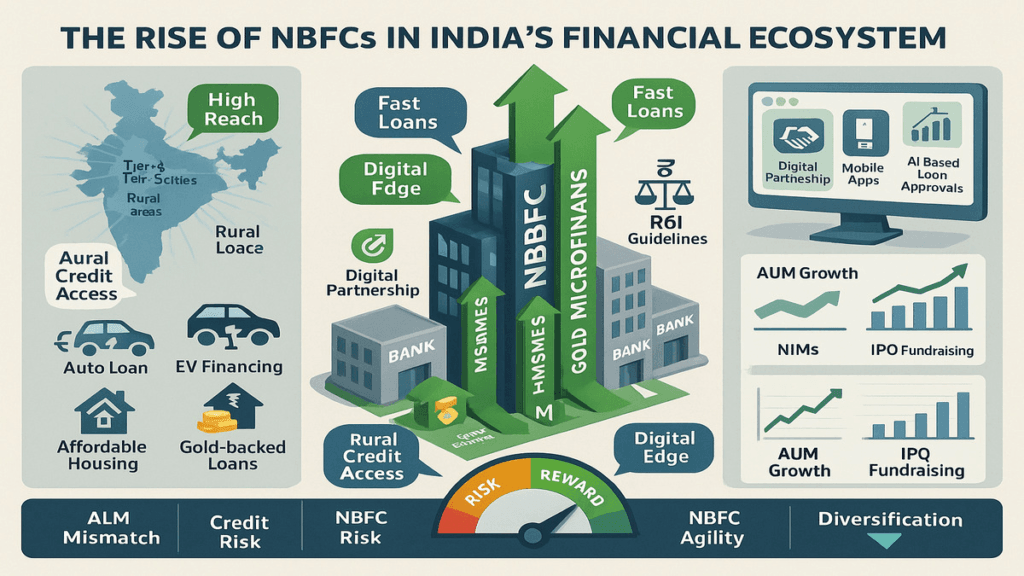

Non-Banking Financial Companies (NBFCs) have emerged as a vital component of India’s financial ecosystem, complementing banks in providing credit, financial services, and liquidity across sectors. Over the past two decades, NBFCs have expanded their presence in retail lending, infrastructure financing, microfinance, and corporate credit. They play a crucial role in reaching underserved markets, supporting small and medium enterprises (SMEs), and facilitating financial inclusion, especially in semi-urban and rural areas where traditional banks have limited reach. Understanding the role, benefits, challenges, and regulatory framework of NBFCs is essential for policymakers, investors, and stakeholders in India’s financial system. This article explores the multifaceted role of NBFCs in India, highlighting their significance, contributions, and future prospects.

Understanding NBFCs

NBFCs are financial institutions that provide banking-like services without holding a full banking license. They are regulated by the Reserve Bank of India (RBI) but operate under a different set of rules than traditional banks. NBFCs cannot accept demand deposits, issue cheques drawn on themselves, or participate in payment and settlement systems like banks. However, they can offer loans, credit facilities, hire-purchase arrangements, leasing, factoring, and investment services.

NBFCs serve as a bridge between the formal banking system and informal credit markets. They often cater to niche segments, such as vehicle loans, housing finance, small business lending, and infrastructure financing, where banks either cannot or choose not to operate due to higher risks, smaller ticket sizes, or lower profitability.

Categories of NBFCs

NBFCs in India operate across multiple sectors, serving different financial needs:

Asset Finance Companies (AFCs)

These NBFCs provide loans for acquiring physical assets such as vehicles, machinery, and industrial equipment. Asset finance companies help businesses and individuals purchase critical assets without immediate capital expenditure, promoting productivity and consumption.

Loan Companies

Loan companies focus on providing unsecured or secured loans to individuals, SMEs, and corporates. They play a vital role in retail credit, bridging the gap between formal banks and borrowers in underserved areas.

Investment Companies

Investment companies deal with buying and selling securities, managing portfolios, and providing long-term financing to businesses. These NBFCs support capital market development and mobilize resources for productive sectors.

Infrastructure Finance Companies (IFCs)

IFCs specialize in financing long-term infrastructure projects, such as roads, power plants, airports, and urban transport. By providing patient capital and flexible repayment structures, IFCs complement government funding and PPP initiatives.

Microfinance Institutions (MFIs)

MFIs are NBFCs that provide small loans to low-income individuals and self-help groups (SHGs) in rural and semi-urban areas. Microfinance enhances financial inclusion, supports livelihood activities, and empowers marginalized communities.

Contributions of NBFCs to India’s Economy

NBFCs have become indispensable to India’s financial ecosystem, contributing in several key areas:

Expanding Credit Access

NBFCs cater to sectors and geographies underserved by traditional banks. By offering small-ticket loans, microfinance, and tailored financial products, NBFCs expand access to credit for individuals, SMEs, and rural populations. This has a direct impact on employment, entrepreneurship, and income generation.

Supporting Infrastructure Development

Infrastructure projects require long-term, high-value financing that banks may be unwilling or unable to provide. Infrastructure Finance Companies (IFCs) fill this gap by offering project financing and structured credit solutions. Their role is crucial in executing projects under the National Infrastructure Pipeline (NIP) and public-private partnerships (PPP).

Facilitating Financial Inclusion

NBFCs, particularly microfinance institutions, have contributed significantly to financial inclusion in India. They provide banking services, insurance, and credit to underserved populations, promoting savings habits and access to formal financial systems. By reaching remote and rural areas, NBFCs bridge the urban-rural financial divide.

Encouraging Innovation in Financial Products

NBFCs often lead in designing innovative financial products tailored to specific market needs. Examples include vehicle loans, gold-backed loans, microloans, digital lending platforms, and specialized SME financing. This innovation enhances competition, efficiency, and customer choice in the financial sector.

Complementing Banks

NBFCs complement traditional banks by sharing credit risks, diversifying funding sources, and reaching niche markets. They help banks reduce operational pressures by targeting segments that may be costly or risky for banks to serve directly. This symbiotic relationship strengthens the overall resilience of India’s financial system.

Regulatory Framework for NBFCs

The Reserve Bank of India (RBI) regulates NBFCs to ensure financial stability, protect depositors’ interests (where applicable), and promote prudent lending practices. Key regulatory requirements include:

- Registration: All NBFCs must register with the RBI to operate legally.

- Capital Adequacy: NBFCs are required to maintain a minimum net owned fund (NOF) and adhere to capital adequacy norms.

- Prudential Norms: Regulations cover asset classification, provisioning, exposure limits, and risk management practices.

- Corporate Governance: NBFCs must follow transparency, board oversight, and reporting standards prescribed by RBI.

- Liquidity Management: Large NBFCs are required to maintain liquidity coverage to meet short-term obligations.

In recent years, the RBI has strengthened regulations to mitigate systemic risks, particularly after instances of NBFC defaults that affected financial markets. Regulatory oversight ensures that NBFCs operate responsibly, maintain solvency, and contribute to financial stability.

Challenges Faced by NBFCs

Despite their importance, NBFCs face several challenges that impact their operations and growth:

Funding Constraints

NBFCs rely heavily on bank loans, debentures, commercial papers, and market borrowings. During periods of tight liquidity or economic stress, funding becomes expensive or scarce, limiting their ability to lend.

Asset Quality Concerns

Unsecured or high-risk lending exposes NBFCs to higher default rates, especially during economic downturns. Maintaining a balance between growth and asset quality is a constant challenge.

Regulatory Compliance

Stringent regulatory requirements, reporting norms, and capital adequacy standards increase operational costs. Smaller NBFCs may struggle to comply, affecting their sustainability.

Competition from Banks and Fintechs

Banks and emerging fintech companies increasingly compete in the same credit segments, putting pressure on NBFCs to innovate, maintain margins, and retain customers.

Market Perception and Investor Confidence

NBFCs’ ability to raise funds depends on investor confidence. Any defaults or negative news can trigger funding shortages and operational stress, affecting growth prospects.

Strategies for Strengthening NBFCs

To enhance the role of NBFCs in India’s financial ecosystem, several strategies can be adopted:

- Diversified Funding: Expanding access to long-term funding through bonds, securitization, and InvITs can reduce liquidity risk.

- Robust Risk Management: Implementing strong credit assessment, portfolio diversification, and monitoring practices ensures asset quality.

- Technology Adoption: Leveraging digital platforms, AI-based credit scoring, and fintech partnerships can improve efficiency, outreach, and customer experience.

- Regulatory Collaboration: Close engagement with RBI and government agencies ensures compliance while facilitating innovation.

- Financial Literacy Initiatives: Educating borrowers, especially in rural areas, reduces default risk and enhances financial inclusion.

Conclusion

NBFCs play a pivotal role in India’s financial ecosystem by providing credit, enhancing financial inclusion, supporting infrastructure development, and promoting innovation. They complement banks, reach underserved markets, and strengthen the economy’s resilience by diversifying financial channels. Regulatory oversight by the RBI ensures stability, while reforms and strategic initiatives can further enhance their efficiency and impact.

Despite challenges such as funding constraints, asset quality risks, and competition, NBFCs remain critical to India’s growth story. Their continued evolution, coupled with technological innovation and prudent regulation, will ensure that they continue to support economic development, empower small businesses and households, and contribute to India’s long-term financial stability.

FAQs

- What are NBFCs and how do they differ from banks?

NBFCs provide banking-like services without a full banking license. They cannot accept demand deposits or issue cheques but offer loans, leasing, and financial products. - What role do NBFCs play in financial inclusion?

NBFCs, especially microfinance institutions, provide credit and financial services to underserved rural and semi-urban populations, promoting savings and access to formal finance. - What are the key challenges faced by NBFCs in India?

Challenges include funding constraints, asset quality risks, regulatory compliance, competition from banks and fintechs, and dependence on investor confidence. - How are NBFCs regulated in India?

The Reserve Bank of India regulates NBFCs through registration, capital adequacy requirements, prudential norms, liquidity management, and corporate governance standards.

Next Topic: AI Applications in Indian Healthcare Sector

Also Check: Infrastructure Financing Models Used in India