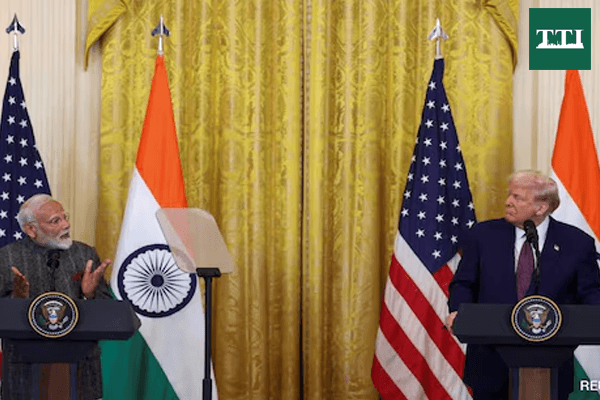

In a decisive step toward strengthening and growing their mutual economic ties, India and the U.S. have introduced a pivotal interim trade framework. This agreement signals a major cooling of trade hostilities, which had previously driven tariffs on Indian exports to 50% amid disagreements regarding trade deficits and Russian oil purchases. By lowering the standard tariff rate to 18% and creating a roadmap for duty-free entry in key industries, the pact cements India’s role as a vital strategic partner and a cornerstone of international supply networks.

Tariff-free access for India’s strongest export sectors

The cornerstone of this agreement is the immediate reduction of the punitive 50% tariff to a more manageable 18%. However, the long-term benefits are even more substantial. Once the interim agreement is fully concluded, the U.S. has committed to removing tariffs entirely on several of India’s most robust export engines. Specifically, generic pharmaceuticals, gems and diamonds, and aircraft parts will enter the American market duty-free.

This shift provides an immense competitive advantage for Indian industries that already hold global leverage. For instance, India’s generic medicine sector, which dominates the global supply, will now find it easier to penetrate the U.S. healthcare system. Similarly, the gems and diamonds sector—a vital source of employment for small and medium enterprises in states like Gujarat and Maharashtra—is set for a significant revival. By eliminating these financial barriers, the deal directly supports the “Make in India” initiative and ensures that Indian products are more attractive to American consumers and businesses.

Also Read: The Trillion-Dollar Impact: Redistributing Half the Wealth of the World’s Richest

Boost for manufacturing ambitions

While India is gaining market access, it is also making strategic concessions that align with its own domestic goals. India has agreed to eliminate or reduce tariffs on a wide range of U.S. industrial goods and agricultural items. This is not merely a trade-off but a calculated move to bolster India’s manufacturing base. By making advanced machinery, medical technology, aviation-grade components, and semiconductor-related hardware cheaper and easier to import, India can integrate high-end technology into its own production lines more efficiently.

Furthermore, the deal addresses long-standing regulatory bottlenecks. Within six months of the agreement taking effect, India is required to decide on the adoption of international or American standards for key sectors such as medical devices and Information and Communication Technology (ICT). This move is expected to clear “long-standing irritants” for global companies, bringing a new level of predictability to the Indian regulatory environment and encouraging more U.S. firms to set up operations in the country.

New push for tech, AI hardware, and supply chains

A pivotal aspect of the framework is its focus on future-oriented technologies. The agreement explicitly strengthens cooperation on hardware essential for artificial intelligence and cloud infrastructure. Both nations have pledged to increase trade in Graphic Processing Units (GPUs) and expand joint work on semiconductors and export-control coordination.

This technical alignment has profound geopolitical implications. It signals a shift in global tech supply chains, positioning India as a “preferred partner” at a time when major economies are actively diversifying away from concentrated production hubs in China. By securing a reliable flow of high-end hardware and collaborating on semiconductor development, India is securing its place in the next generation of global technological innovation.

Clearer rules, faster approvals for businesses

Beyond the headlines of tariff cuts, the agreement focuses on reducing the day-to-day friction of international business. India and the U.S. will begin coordinating on testing standards, certification processes, and conformity assessments. For exporters, this means fewer repeat tests and a reduction in regulatory surprises, leading to faster turnaround times for products entering either market.

While less flashy than a 0% tariff, these administrative improvements are often what determine the success of trade relations. The increased predictability and ease of doing business are expected to be among the most valuable aspects of the deal for exporters who have previously struggled with invisible hurdles and stringent U.S. quality standards.

Farm sector remains protected

Despite the broad opening of markets, India has successfully maintained protections for its most sensitive agricultural products. Staples such as wheat, rice, maize, dairy, and poultry remain outside the tariff-cut list. This ensures that the livelihoods of millions of Indian farmers are not disrupted by a sudden influx of subsidized American crops.

By keeping these “sensitive” sectors protected while simultaneously expanding access for high-value exports, the Indian government has achieved a pragmatic balance. The deal provides the economic growth needed for industrial and tech sectors without compromising the security of the rural economy. In summary, the 2026 trade pact is a strategic “give-and-take” that trades energy and market concessions for manufacturing survival and high-tech dominance.

Also Read: A New Reality: US Trade Map Recognizes PoK and Aksai Chin as India