The exchange rate between the Indian Rupee (INR) and the US Dollar (USD) plays a crucial role in India’s economy, affecting trade, investment, inflation, and overall financial stability. Currency fluctuations are influenced by multiple domestic and international factors, including economic policies, market sentiment, global events, and geopolitical dynamics. Understanding the causes behind these fluctuations and their implications is essential for businesses, investors, policymakers, and everyday consumers. This article explores why the rupee fluctuates against the dollar and how these movements impact India’s economy, trade, and financial markets.

Factors Influencing the Rupee-Dollar Exchange Rate

The value of the rupee relative to the dollar is determined by the foreign exchange (forex) market, where supply and demand for both currencies play a primary role. Several key factors drive fluctuations:

Trade Balance

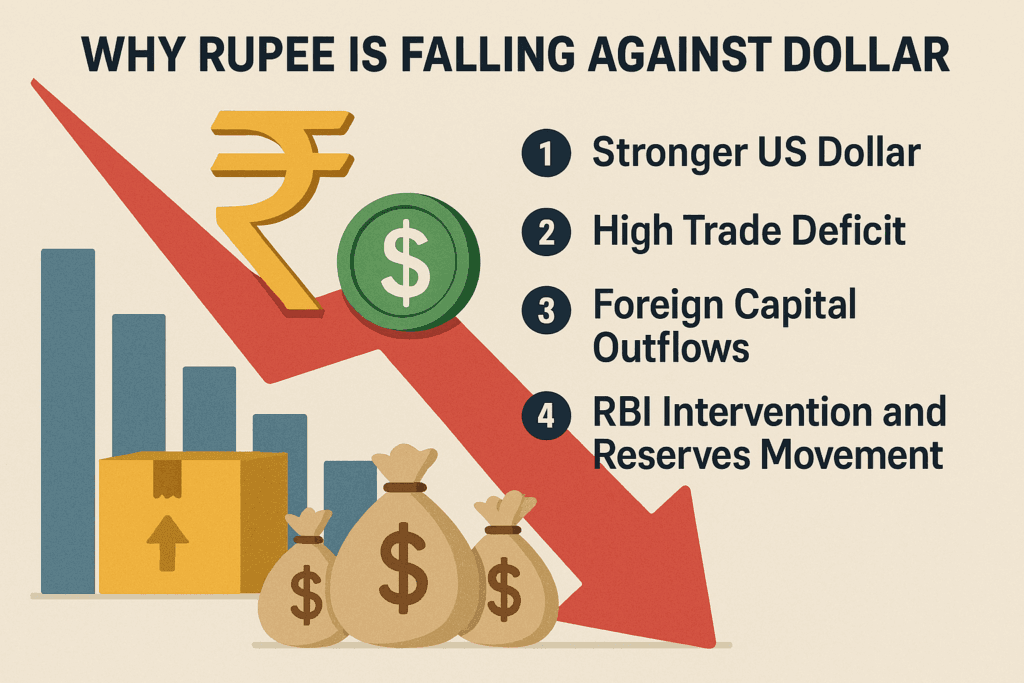

India’s trade balance—the difference between exports and imports—significantly affects the rupee. When imports exceed exports, there is higher demand for foreign currency to pay for goods, creating downward pressure on the rupee. Conversely, if exports surpass imports, the demand for rupees increases as foreign buyers pay in INR, supporting the currency’s value.

Key import items such as crude oil, gold, and electronic goods contribute heavily to trade deficits. For instance, rising oil prices increase import bills, leading to more demand for dollars and putting pressure on the rupee. Similarly, export performance in sectors like IT services, textiles, and pharmaceuticals can support the currency during periods of strong foreign demand.

Foreign Investment Flows

Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) influence currency movements. When international investors invest in Indian stocks, bonds, or infrastructure projects, they convert dollars into rupees, strengthening the domestic currency. On the other hand, if foreign investors withdraw capital due to global uncertainties, economic slowdown, or higher returns abroad, the rupee may depreciate.

Global interest rate changes, particularly in the United States, can impact investment flows. For example, higher US interest rates may attract investors to dollar-denominated assets, causing capital outflows from India and weakening the rupee.

Inflation and Interest Rates

Inflation differentials between India and other countries also influence currency fluctuations. Higher domestic inflation reduces the rupee’s purchasing power relative to foreign currencies, leading to depreciation. Similarly, interest rate policies by the Reserve Bank of India (RBI) affect investor sentiment. Higher interest rates can attract foreign capital, supporting the rupee, while lower rates may result in currency weakness.

Geopolitical Events and Global Markets

Geopolitical tensions, natural disasters, or financial crises in major economies can impact currency stability. Investors often seek safe-haven assets, such as the US dollar, during uncertain times. This increased demand for dollars leads to depreciation of emerging market currencies, including the rupee. Global stock market volatility, trade wars, and changes in commodity prices can also contribute to short-term fluctuations.

Speculation and Market Sentiment

Currency markets are influenced by speculative activities and market sentiment. Traders in forex markets react to economic data, political developments, and central bank announcements, which can result in rapid fluctuations. Speculation based on expected policy changes or macroeconomic indicators can amplify short-term volatility in the rupee-dollar exchange rate.

Impact of Rupee Fluctuation on India

The movement of the rupee against the dollar has wide-ranging implications for various sectors of the Indian economy.

Imports and Inflation

A weaker rupee makes imports more expensive, increasing costs for products such as crude oil, electronics, machinery, and gold. Higher import costs can lead to inflationary pressures, affecting the prices of goods and services across the economy. Rising fuel prices due to a weaker rupee directly impact transportation, logistics, and household expenditure, creating a ripple effect in the overall cost of living.

Exports and Trade Competitiveness

A depreciating rupee can benefit exporters by making Indian goods cheaper in international markets. Sectors like IT services, textiles, pharmaceuticals, and automotive manufacturing may gain a competitive advantage, boosting foreign revenue. Conversely, a strong rupee can reduce export competitiveness, potentially impacting revenue for Indian companies operating internationally.

Foreign Investment and Capital Flows

Currency fluctuations influence investor confidence. A volatile or weakening rupee may discourage foreign investment, as returns in rupee terms could be uncertain when converted back to dollars. Conversely, a stable or appreciating rupee can attract FDI and FPI, strengthening capital inflows and supporting economic growth. Financial markets are sensitive to exchange rate changes, with equity and bond prices often reacting to currency movements.

Corporate Earnings and Debt

Indian companies with significant overseas exposure or foreign currency-denominated debt are affected by rupee fluctuations. A weaker rupee increases the cost of servicing foreign debt and reduces profit margins for firms importing raw materials. Conversely, companies earning revenue in foreign currency benefit from a weaker rupee, as their earnings convert to higher INR amounts. This dynamic affects sectors differently, depending on their reliance on imports, exports, and international financing.

Household Impact

Currency fluctuations can directly affect households, particularly through imported goods and services. Prices of consumer electronics, fuel, and imported food items may rise with a weaker rupee, increasing household expenditure. Conversely, a stronger rupee can reduce the cost of imported goods, benefiting consumers. International travel and education expenses also fluctuate with currency movements, impacting personal finance decisions.

Role of the Reserve Bank of India

The Reserve Bank of India plays a crucial role in managing currency stability through monetary policy, forex reserves, and market interventions. The RBI may buy or sell dollars in the open market to prevent excessive volatility and maintain orderly currency movement.

The central bank also monitors macroeconomic indicators, inflation, and capital flows to implement policy measures that support the rupee. Interest rate adjustments, liquidity management, and currency swap agreements are some tools used by the RBI to influence exchange rates. By maintaining stability, the RBI helps create a conducive environment for trade, investment, and overall economic growth.

Strategies for Businesses and Investors

Understanding rupee-dollar dynamics is essential for businesses and investors to mitigate risk and optimize financial outcomes:

- Hedging Currency Risk: Companies and investors can use forward contracts, options, or swaps to hedge against adverse currency movements.

- Diversifying Investments: Maintaining a diversified portfolio of domestic and foreign assets can reduce exposure to currency volatility.

- Monitoring Economic Indicators: Keeping track of trade balances, inflation, interest rates, and global developments helps anticipate potential rupee movements.

- Long-Term Planning: Businesses engaged in imports, exports, or foreign borrowing should integrate currency considerations into strategic planning to manage costs and profitability.

Conclusion

The rupee-dollar exchange rate is influenced by a complex interplay of domestic and global factors, including trade balances, inflation, interest rates, investment flows, and market sentiment. Fluctuations impact imports, exports, corporate earnings, foreign investment, and household finances. While a weaker rupee can boost exports and attract foreign earnings for some sectors, it can also increase import costs, inflation, and debt servicing burdens. Conversely, a stronger rupee benefits consumers and companies reliant on imports but may reduce export competitiveness.

For businesses, investors, and policymakers, understanding the dynamics of rupee-dollar fluctuations is critical for risk management, strategic decision-making, and maintaining economic stability. The Reserve Bank of India plays a key role in moderating volatility, ensuring a balance between market forces and policy interventions. By staying informed and adopting appropriate strategies, stakeholders can navigate currency fluctuations while maximizing opportunities and minimizing risks in India’s evolving economic landscape.

FAQs

- What factors cause the rupee to fluctuate against the dollar?

Major factors include trade balance, foreign investment flows, inflation, interest rates, global events, and market speculation. - How does a weaker rupee impact imports and inflation?

A weaker rupee makes imports more expensive, leading to higher costs for goods like oil, electronics, and machinery, which can contribute to inflation. - Who benefits from a depreciating rupee?

Exporters and businesses earning revenue in foreign currency benefit as their earnings convert to higher INR values. - What role does the RBI play in currency stability?

The Reserve Bank of India intervenes in forex markets, manages monetary policy, and monitors economic indicators to prevent excessive volatility.

Next Topic: India Must Accelerate AI and Industrial Automation to Unlock Manufacturing Potential: A Strategic Imperative

Also Check: Taxation on Crypto in India: Income Tax & TDS Explained