The financial technology (fintech) sector in India has emerged as one of the fastest-growing industries, transforming the way consumers and businesses access financial services. With innovations spanning digital payments, lending platforms, neobanks, insurance technology (InsurTech), and investment solutions, fintech is democratizing finance, enhancing convenience, and driving financial inclusion. However, alongside its rapid growth, the sector faces significant regulatory challenges. India’s fintech ecosystem operates within a complex framework of laws, guidelines, and compliance requirements designed to protect consumers, ensure systemic stability, and promote transparency. Navigating these regulatory challenges is critical for fintech companies to sustain growth, maintain trust, and scale operations. This article explores the key regulatory hurdles, their implications, and strategies for fintech companies in India.

The fintech industry in India is diverse, encompassing payment processors, peer-to-peer (P2P) lending platforms, digital wallets, wealth management platforms, and blockchain-based solutions. According to industry reports, India’s fintech sector is projected to reach over $150 billion in transaction value by 2025, driven by rising smartphone adoption, digital literacy, and government initiatives like Digital India, Unified Payments Interface (UPI), and Jan Dhan Yojana. Despite this growth, fintech companies must navigate a labyrinth of regulatory frameworks imposed by the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), and other authorities.

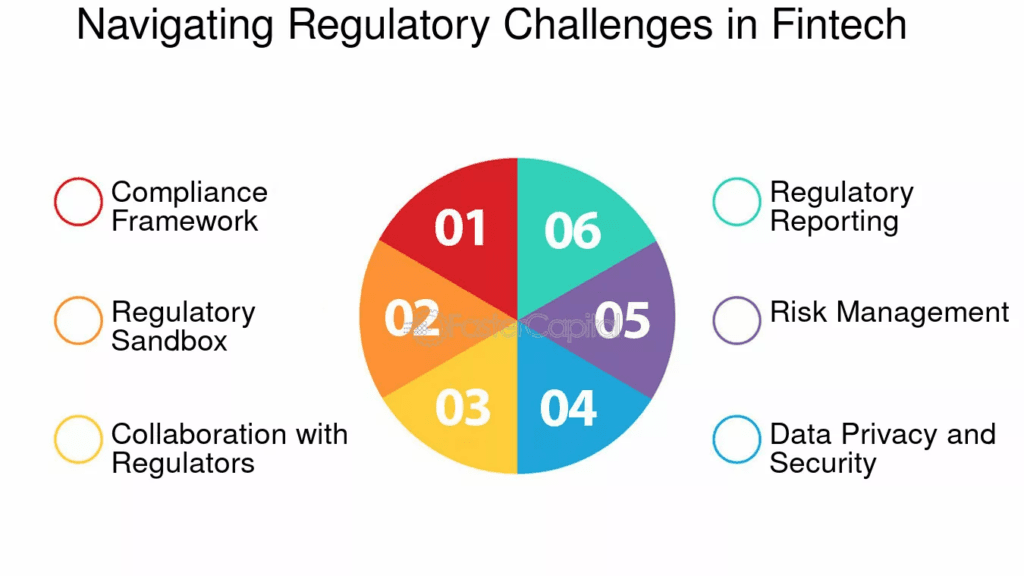

Key Regulatory Challenges

- Licensing and Compliance Requirements

Fintech companies often require licenses to operate in specific segments. For example, digital lending platforms need registration as non-banking financial companies (NBFCs) or partnerships with banks, while payment gateways must comply with RBI guidelines for payment systems. Obtaining licenses involves meeting stringent capital requirements, operational standards, and reporting obligations, which can be resource-intensive for startups. Continuous regulatory updates require fintechs to remain agile and ensure ongoing compliance, which adds to operational complexity. - Data Privacy and Security Regulations

India is in the process of implementing the Data Protection Bill, which will impose strict requirements on the collection, storage, processing, and sharing of customer data. Fintech companies handle sensitive financial and personal information, making compliance with data protection, cybersecurity standards, and consent management critical. Non-compliance can lead to penalties, reputational damage, and loss of consumer trust. - KYC and Anti-Money Laundering Compliance

Know Your Customer (KYC) norms, Anti-Money Laundering (AML) guidelines, and Counter-Terrorism Financing (CTF) regulations are essential for safeguarding the financial system. Fintech companies offering loans, digital wallets, or investment services must verify customer identities, track transactions, and report suspicious activities. Compliance with these norms requires sophisticated technology, operational diligence, and trained personnel. Failing to meet regulatory expectations can result in legal action and financial penalties. - Regulatory Uncertainty for Emerging Technologies

Innovations such as blockchain, cryptocurrency, and decentralized finance (DeFi) often operate in regulatory grey areas. For instance, while cryptocurrencies are widely traded, India has yet to establish a clear legal framework governing their use, taxation, or investment. Fintech startups experimenting with such technologies face uncertainty and potential regulatory scrutiny, which may hinder innovation and investment. - Cross-Border Regulations and Foreign Investment

Many fintech companies collaborate with international partners or receive foreign direct investment (FDI). Compliance with cross-border data transfer regulations, foreign ownership limits, and international financial laws can be challenging. Fintechs must ensure that their operations adhere to both Indian laws and global standards to avoid conflicts and regulatory penalties. - Consumer Protection and Redressal Mechanisms

As fintech platforms handle payments, lending, and investment services, consumer grievances regarding fraud, transaction failures, or mismanagement are common. Regulators emphasize transparent grievance redressal mechanisms, dispute resolution, and user-friendly policies. Companies failing to provide effective consumer protection may face fines, license revocation, and reputational harm.

Impact of Regulatory Challenges

Regulatory challenges impact fintech companies in multiple ways. Compliance costs can be high, especially for startups with limited resources. Operational delays, legal risks, and administrative burdens may slow down innovation and product deployment. On the other hand, clear and robust regulatory frameworks can foster trust, encourage investment, and protect consumers, ultimately contributing to sector growth. Balancing innovation with regulatory adherence is a delicate task for fintech companies in India.

Moreover, regulatory hurdles can influence the competitive landscape. Large, well-capitalized firms may more easily absorb compliance costs, while smaller startups struggle to meet regulatory requirements. This can lead to market consolidation, where a few major players dominate, potentially reducing diversity and innovation.

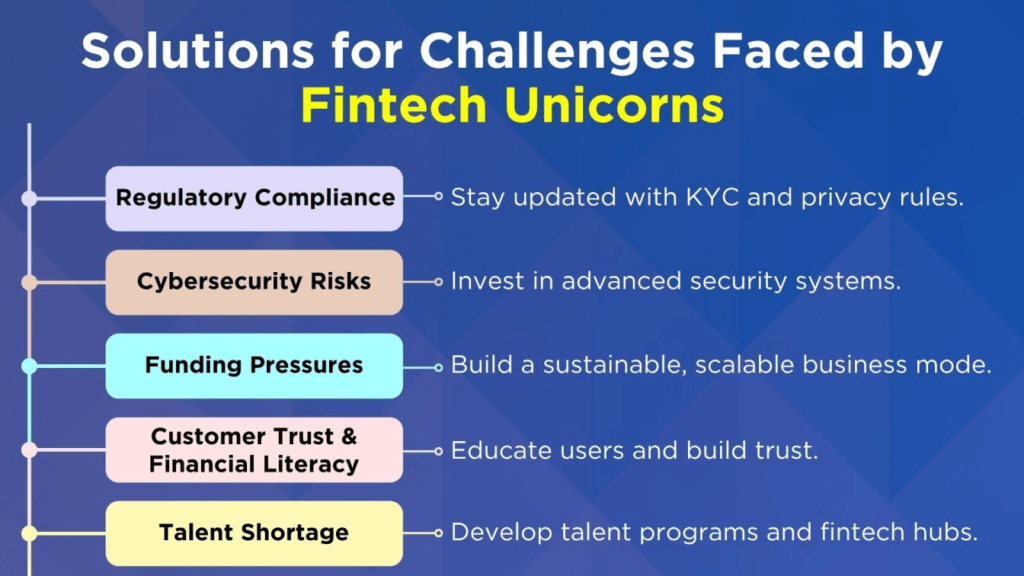

Strategies for Fintech Companies to Navigate Regulations

- Proactive Engagement with Regulators

Maintaining regular communication with RBI, SEBI, IRDAI, and other relevant authorities helps fintech companies stay updated on new guidelines and policy changes. Industry associations and forums also provide platforms to discuss regulatory challenges and advocate for supportive policies. - Investing in Compliance Technology

Regtech solutions, including automated KYC verification, AML monitoring, fraud detection, and reporting tools, can reduce operational burdens while ensuring regulatory compliance. Leveraging AI and machine learning can enhance risk management and improve accuracy. - Legal and Risk Advisory Support

Hiring experienced legal counsel and risk management professionals enables fintech companies to interpret regulations, maintain proper documentation, and implement robust governance frameworks. This proactive approach minimizes legal disputes and regulatory penalties. - Consumer-Centric Policies

Prioritizing transparency, privacy, and dispute resolution fosters trust and aligns with regulatory expectations. Clear terms of service, secure transaction processes, and responsive grievance handling are essential to maintain credibility and reduce regulatory scrutiny. - Strategic Partnerships

Collaborating with banks, insurance companies, and other regulated entities helps fintech companies navigate licensing requirements and expand services while remaining compliant. Partnerships also provide access to expertise, technology, and customer bases that may otherwise be difficult to develop independently.

Government Initiatives Supporting Fintech

The Indian government and regulatory bodies have taken proactive steps to support the fintech ecosystem while ensuring consumer protection and financial stability. Initiatives such as the Digital India program, UPI system, Startup India, and regulatory sandboxes introduced by RBI and SEBI allow fintech startups to test innovative products under controlled environments. These measures reduce regulatory uncertainty, promote innovation, and create opportunities for collaboration between fintechs and traditional financial institutions.

The RBI’s Payment System Vision 2025 emphasizes secure, inclusive, and interoperable digital payment systems, reflecting the government’s commitment to fostering fintech growth. Similarly, SEBI has developed frameworks for digital investment platforms and robo-advisory services, encouraging innovation while safeguarding investors.

Future Outlook

The future of fintech in India is promising, with continued growth in digital payments, lending, wealth management, and blockchain-based solutions. Regulatory challenges are expected to evolve alongside technological advancements, requiring companies to remain agile and adaptive.

Fintech companies that embrace regulatory compliance as a strategic advantage will gain consumer trust, attract investors, and sustain long-term growth. Collaboration with regulators, investments in technology, and transparent operational practices will be key to navigating India’s complex regulatory environment. Over time, regulatory clarity, combined with technological innovation, is likely to strengthen India’s position as a global fintech hub.

Conclusion / Final Thoughts

India’s fintech sector is at a transformative stage, reshaping financial services and promoting financial inclusion. While regulatory challenges present significant hurdles, they also provide a framework for trust, transparency, and stability. Licensing requirements, data privacy, KYC norms, emerging technologies, and consumer protection are critical areas that fintech companies must address to operate effectively. By proactively engaging with regulators, investing in compliance technology, implementing consumer-centric policies, and forming strategic partnerships, fintech companies can navigate regulatory complexities and thrive in India’s dynamic market. A strong regulatory foundation, combined with innovation, will ensure that fintech continues to drive growth, inclusion, and efficiency in the Indian financial ecosystem.

FAQs

1. Why do fintech companies face regulatory challenges in India?

Fintechs operate in a heavily regulated sector with multiple authorities, handling sensitive financial data, emerging technologies, and consumer transactions, requiring strict compliance.

2. How can fintech companies comply with KYC and AML regulations?

By implementing automated KYC verification, fraud detection tools, AI-based monitoring, and maintaining thorough records, fintechs can meet regulatory requirements effectively.

3. What role do regulatory sandboxes play for fintech startups?

Regulatory sandboxes allow startups to test innovative products under controlled environments, helping them comply with regulations while encouraging innovation.

4. How do regulatory challenges affect small fintech startups?

Compliance costs, legal complexity, and operational burdens can be higher for small startups, potentially limiting growth compared to larger, well-capitalized firms.

Next Topic: Medical Tourism in India: Business Opportunities

Also Check: Smart Cities Mission in India: Progress and Challenges